Controversial plans

Resource Capital Funds purchased Ambre Energy's coal export proposals amid declining coal markets, a key permit denial, and widespread opposition - even Ambre's board admitted to a "significant reduction" in the company's value.

Resource Capital Funds purchased Ambre Energy's coal export proposals amid declining coal markets, a key permit denial, and widespread opposition - even Ambre's board admitted to a "significant reduction" in the company's value.

|

While Resource Capital Funds has played a quiet but important role in coal export proposals for years, it recently increased its involvement - the Oregonian reported in November 2014:

Ambre is selling its interests in its Oregon and Washington projects to a U.S.-based private equity company, Resource Capital Funds of Denver, Colo. Ambre's board has approved the $18 million deal, most of which will pay off debt, and company shareholders are expected to follow suit in December. Its Utah subsidiary, Ambre Energy North America, will be transferred to Resource Capital and remain the face of the export projects. Its leadership team will remain. The Decker Mine in Montana and Black Butte Mine and Big Horn coal deposit in Wyoming are included in the deal. That means that Resource Capital Funds now holds Ambre Energy's 62% stake in the Millennium Bulk coal export proposal in Longview, Washington, which the company hopes will one day export 44 million tons of coal each year. Resource Capital Funds now also holds Ambre Energy's Morrow Pacific coal export proposal in Boardman, Oregon. Key permit denied amid widespread opposition Both coal export proposals have faced widespread opposition from communities that would be impacted by increased rail traffic, coal dust, and disruption to tribal fishing areas. In August 2014, the Oregon Department of State Lands denied a required permit for the Morrow Pacific coal export proposal, because it "is not consistent with the protection, conservation and best use of the state's water resources." In particular, Oregon regulators determined that the coal export proposal would interfere with Columbia River tribes' rights to use traditional fisheries, and tribal leaders applauded the decision: “Today’s landmark decision reflects what is in the best interest of the region, not a company’s pocketbook,” said Carlos Smith, chairman of the Columbia River Inter-Tribal Fish Commission and a member of the Warm Springs Tribal Council. “This decision is one that we can all celebrate. It reaffirms the tribal treaty right to fish and is in the best interest of the Columbia Basin’s salmon populations and our communities. It is a reflection of what is best for those who would be forced to live with the consequences of Ambre’s proposal, not what is best for those who would profit from it. This is the beginning of the end for this toxic threat – the tribes will stand with the State to protect its sound decision.” Learn more about widespread community opposition to Resource Capital Funds' coal export proposals.

Collapsing global coal market

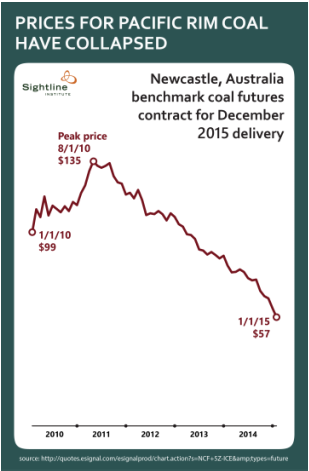

In addition to rejected permits and unprecedented opposition, Resource Capital Funds' coal export proposals face a declining global coal market: For more than two years, the US coal industry has predicted that international coal prices would soon rebound, breathing new life into coal export and mining proposals that are now languishing on financial life support. But despite the industry’s hopes, the bottom keeps falling out of the global coal market. Market conditions for Pacific Rim coal exporters are now worse than they’ve been since the depths of the global recession. After peaking in early 2011 at more than $130 per ton, the price of benchmark Australian coal has fallen for nearly 4 consecutive years. In December, they reached a 5-year low of $62 in December, according to the World Bank. The challenges for US coal exports to Asia as prices fall are detailed in a report from the Institute for Energy Economics and Financial Analysis, No Need for New U.S. Coal Ports: Data Shows Oversupply in Capacity, as well as analyst reports from Wall Street Banks like Goldman Sachs and Deutsche Bank. Ambre admits to "significant reduction" in value of coal export proposals

In fact, Ambre Energy's own board of directors pointed to the declining global coal market, permit denial, and other headwinds as an explanation to shareholders for the "significant reduction in the net value" of the company and cut-rate sale to Resource Capital Funds, as Sightline Institute detailed in What Ambre Says About Its Financial Collapse: In a section in which Ambre’s board of directors recommends that shareholders approve the sale of Ambre’s assets to RCF, the board describes the company’s dire financial situation as follows:

Sightline Institute's look at some of Resource Capital Funds' other investments suggests why it might have purchased Ambre Energy's coal export proposals, despite dim prospects: RCF actively seeks out risky projects with a high potential for failure. RCF has carved out a niche investing in small mining companies in volatile markets—just the sort of risky gambles that blue-chip investors shy away from... RCF’s investment shows that it was hoping to ride a volatile commodity market in hopes of short term gains. As Businessweek points out, RCF has a three to five year horizon for its investments—meaning that it doesn’t have much of a financial stake in what happens in year six. |

|